Jumbo Loan: Tailored Mortgage Solutions for High-Income Debtors

Jumbo Loan: Tailored Mortgage Solutions for High-Income Debtors

Blog Article

The Influence of Jumbo Financings on Your Financing Options: What You Required to Know Before Using

Jumbo financings can play a crucial function in forming your financing options, particularly when it concerns acquiring high-value residential properties. While they supply the chance for bigger financing quantities without the problem of exclusive home mortgage insurance (PMI), they likewise come with strict qualification standards that call for careful consideration. Recognizing the equilibrium between the advantages and difficulties postured by these lendings is vital for possible borrowers. As you consider your choices, the effects of rates of interest and item schedule may prompt you to reassess your economic method progressing (jumbo loan).

Comprehending Jumbo Lendings

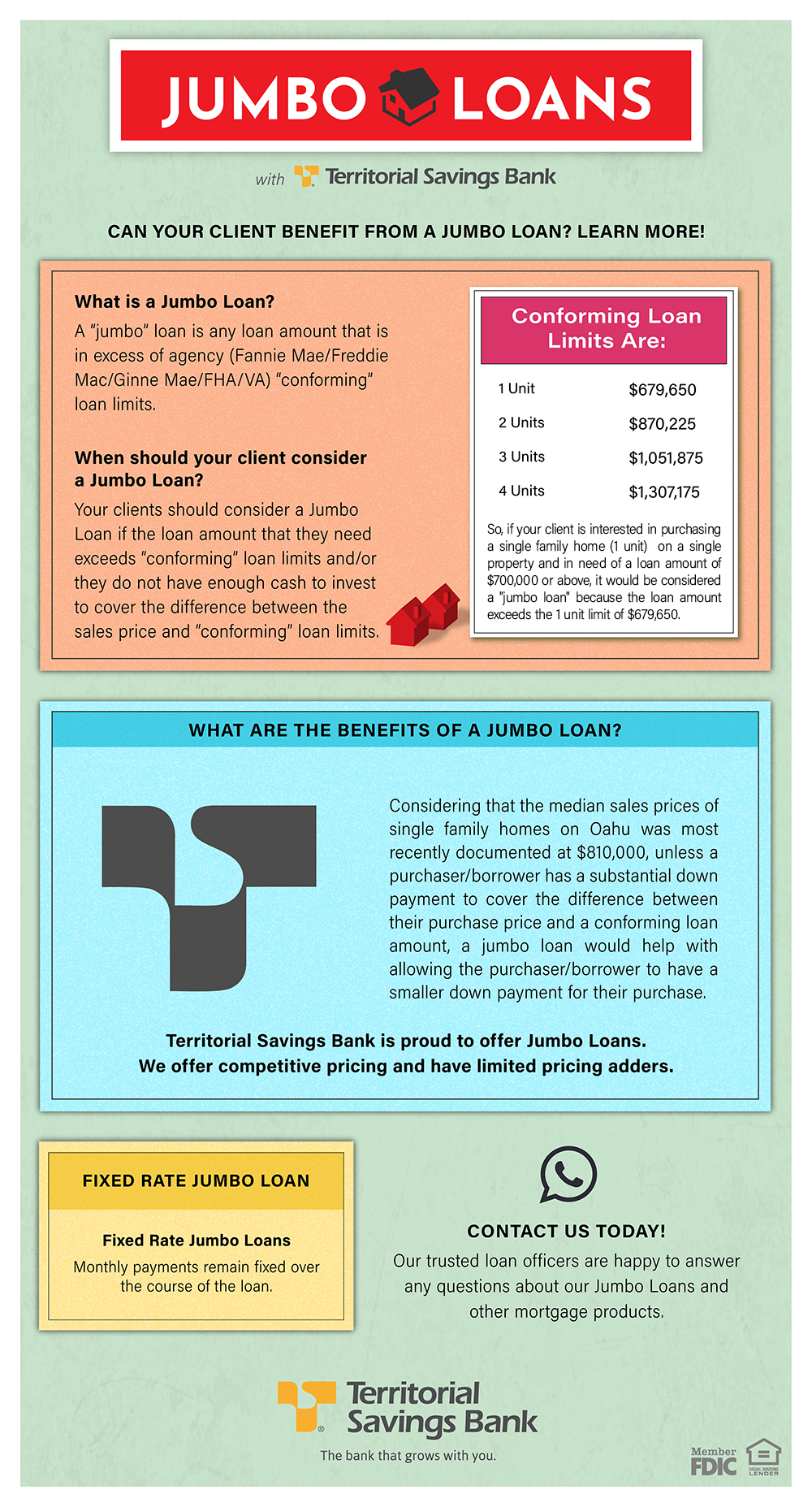

Recognizing Jumbo Loans calls for a clear understanding of their special characteristics and requirements. Jumbo fundings are a kind of home mortgage that surpasses the adjusting financing restrictions developed by the Federal Real Estate Finance Firm (FHFA) These limitations vary by location but typically cap at $647,200 in many areas, making jumbo finances vital for financing higher-priced residential or commercial properties.

One of the defining features of big car loans is that they are not eligible for acquisition by Fannie Mae or Freddie Mac, which brings about more stringent underwriting standards. Consumers should commonly show a greater credit rating, usually over 700, and offer considerable paperwork of earnings and possessions. In addition, lending institutions might call for a bigger deposit-- often 20% or more-- to alleviate danger.

Rate of interest rates on jumbo car loans can be a little greater than those for adjusting finances because of the raised threat assumed by the lender. The lack of exclusive mortgage insurance policy (PMI) can counter some of these costs. Comprehending these variables is essential for potential debtors, as they significantly affect the terms and usefulness of securing a big finance in today's competitive property market.

Advantages of Jumbo Financings

Jumbo car loans provide distinct benefits for property buyers looking for to buy high-value homes that surpass standard financing limitations. One of the primary advantages of big fundings is their ability to fund larger quantities, allowing customers to obtain homes in premium markets without the constraints enforced by adapting loan limits - jumbo loan. This versatility allows homebuyers to view a more comprehensive variety of properties that may much better match their choices and requirements

In addition, jumbo car loans frequently include affordable rate of interest rates, specifically for consumers with strong credit rating profiles. This can bring about considerable cost savings over the life of the funding, making homeownership a lot more economical over time. Jumbo car loans can be customized to match individual monetary scenarios, providing numerous terms and amortization options that line up with the consumer's objectives.

Challenges of Jumbo Fundings

Navigating the intricacies of big car loans presents several obstacles that potential borrowers need to be mindful of prior to proceeding. Unlike adjusting financings, big fundings are not backed by government-sponsored business, leading lending institutions to embrace even more strenuous standards.

Additionally, jumbo financings normally come with greater rates of interest compared to traditional finances. This elevated expense can significantly impact regular monthly settlements and total cost, making it vital for consumers to meticulously assess their monetary situation. Additionally, the down settlement needs for big lendings can be significant, commonly varying from 10% to 20% or even more, which can be a barrier for several possible home owners.

Another difficulty depends on the limited accessibility of jumbo lending products, as not all lending institutions use them. This can bring about a decreased swimming pool of choices, making it important for customers to carry out extensive study and potentially look for specialized lenders. On the whole, comprehending these obstacles is important for anyone thinking about a jumbo loan, as it makes sure enlightened decision-making and better financial planning.

Credentials Criteria

For those taking into consideration a big funding, meeting the credentials criteria is an essential action in the application process. special info Unlike standard financings, jumbo lendings are not backed by federal government firms, resulting in stricter needs.

To start with, a solid credit history rating is important; most loan providers call for a minimum score of 700. In addition, consumers are usually expected to demonstrate a considerable earnings to ensure they can pleasantly handle higher regular monthly settlements.

Down settlement requirements for big car loans are additionally considerable. Customers ought to anticipate placing down at the very least 20% of the home's acquisition cost, although some lenders might use alternatives as low as 10%. In addition, showing money books is crucial; lending institutions commonly need evidence of adequate fluid assets to cover several months' worth of mortgage repayments.

Contrasting Financing Options

When assessing financing options for high-value homes, comprehending the distinctions between different funding kinds is vital. Jumbo car loans, which surpass conforming loan limitations, typically featured stricter credentials and higher rate of interest prices than traditional loans. These loans are not backed by government-sponsored business, which enhances the lending institution's danger and can bring about much more rigorous underwriting requirements.

In contrast, conventional financings supply more adaptability and are often simpler to get for consumers with strong credit scores accounts. They may come with lower rates of interest and a broader variety of choices, such as repaired or variable-rate mortgages. Additionally, government-backed lendings, like FHA or VA financings, offer chances for lower deposits and more lax credit scores demands, though they also enforce limitations on the loan quantities.

Conclusion

Finally, jumbo financings existing both opportunities and challenges for prospective homebuyers seeking financing for high-value homes. While these finances permit bigger quantities without the problem of personal home loan insurance coverage, they include rigid certification demands and potential drawbacks such as higher rate of interest. A comprehensive understanding of the benefits and obstacles related to jumbo finances is necessary for making notified decisions that align with lasting economic goals and purposes in the realty market.

Report this page